Welcome back to PI Circular! In this edition, we will examine the latest in PET thermoform recycling and Extended Producer Responsibility (EPR) legislation in the U.S.

Unlocking the Potential of PET Thermoform Recycling

Recycling PET thermoforms is finally gaining momentum after years of lagging behind more commonly recycled materials like PET bottles. Plastic Ingenuity is proud to have contributed to a recently published white paper from the National Association for PET Container Resources (NAPCOR) that details encouraging progress and highlights the work that remains to make thermoform recycling a mainstream practice across the U.S.

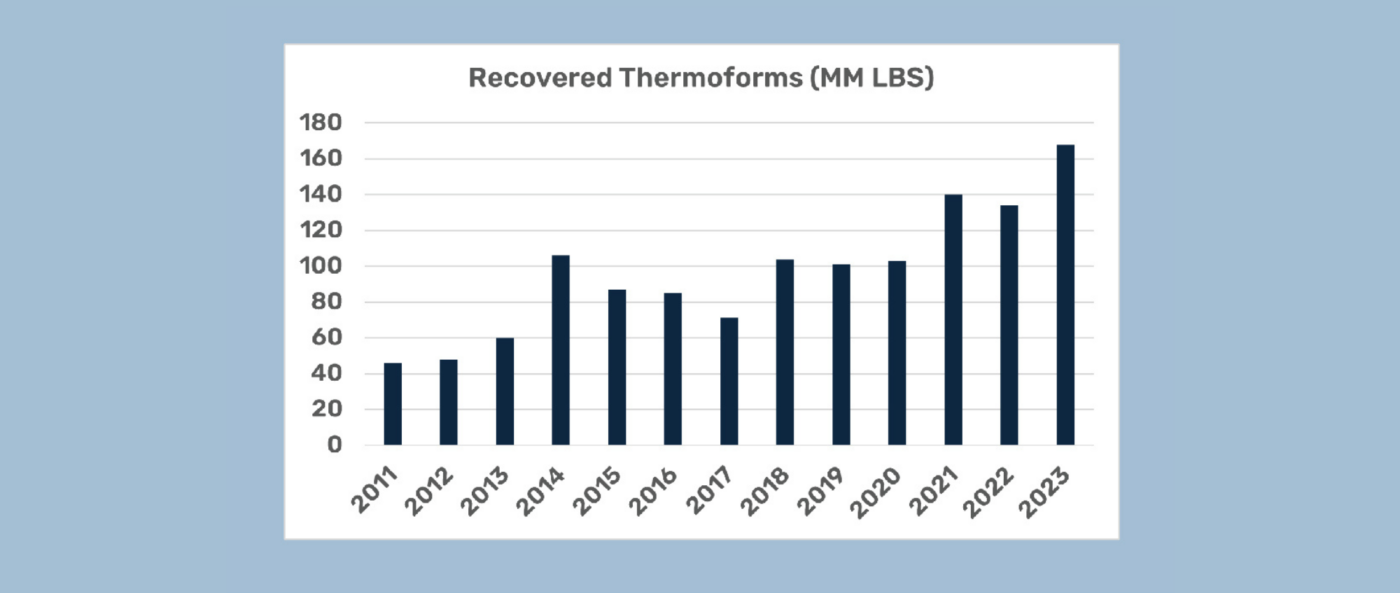

A Decade of Progress

Between 2011 and 2023, PET thermoform recycling experienced significant innovation and growth. The volume of recycled PET thermoforms more than tripled in that period, reaching 130 million pounds in 2023. An additional 38 million pounds were exported for recycling, bringing the total volume to nearly 170 million pounds. This marks a substantial leap from earlier years when the material saw limited recycling due to technological and market challenges.

Despite this growth, PET thermoform recycling is still far from achieving the same level of accessibility and efficiency as bottle recycling. The journey toward mainstreaming this material’s recycling is ongoing, with infrastructure, policy, and public awareness all playing critical roles.

What Makes Thermoforms So Challenging?

One of the primary obstacles to recycling PET thermoforms has been contamination. These packages often resemble other types of plastic—such as polystyrene or polyvinyl chloride—which can confuse sorting equipment and compromise the quality of recycled material. Additionally, thermoforms come in a wide range of sizes and shapes, which makes them difficult for material recovery facilities (MRFs) to sort efficiently.

Historically, MRFs have been optimized to process standard packaging types like bottles, which are easier to identify and separate. The irregular shapes and lower weight of thermoforms posed significant issues in fast-moving, high-volume operations. However, this is beginning to change.

Technology Leads the Way

Recent advances in sorting technology are making a big difference. Modern MRFs are increasingly equipped with optical sorters and artificial intelligence (AI) systems that can distinguish PET thermoforms from other materials more accurately. One notable example is a new MRF opened by Rumpke Waste & Recycling in Columbus, Ohio. Thanks to its cutting-edge equipment, this facility can now accept thermoforms in select markets, paving the way for broader acceptance.

In addition to improved sorting capabilities, the industry has made strides in creating thermoform packaging that is more compatible with recycling systems. New adhesives dissolve during wash cycles, and labels are being designed to detach more easily. These innovations reduce contamination and increase the likelihood that PET thermoforms can be successfully recycled into high-quality material.

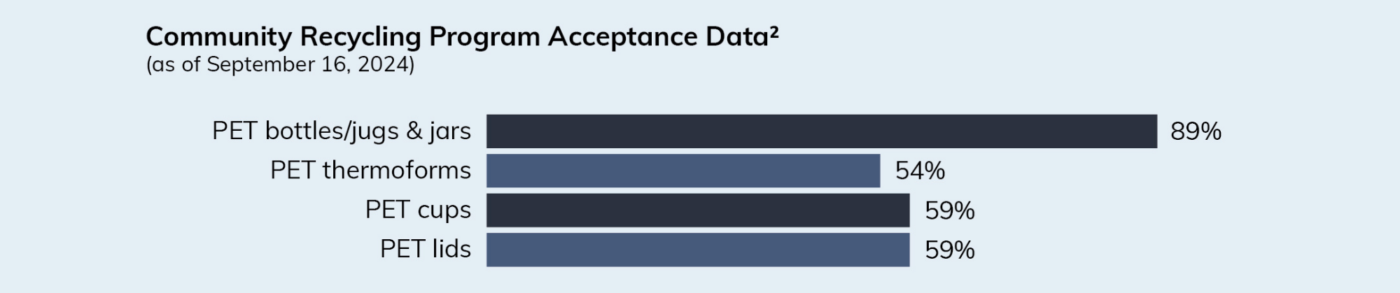

Expanding Access and Infrastructure

Despite technological progress, public access to thermoform recycling remains inconsistent. Nationally, about 54% of U.S. residents have access to some form of PET thermoform recycling. However, this access varies widely by location. For instance, California boasts an 88% access rate, while Oregon reports none at all.

This patchwork of availability highlights a critical challenge: expanding recycling access uniformly across the country. Without consistent infrastructure, even the best recycling technologies and practices cannot reach their full potential.

Toward a Circular Economy

One of the promising developments in the PET thermoform sector is the increasing use of post-consumer recycled (PCR) content. Thermoforms are not only being recycled into new products, but the packaging itself now includes more PCR content and less virgin resin. Between 2021 and 2023, the use of recycled feedstock by thermoform converters saw a noticeable increase. By 2023, 74% of the PET used in thermoform manufacturing was virgin material—down nine percentage points from the year before.

This shift not only helps reduce environmental impact but also creates a viable end market for recycled thermoforms. Strong end markets are essential to making recycling economically sustainable, as they drive demand for PCR materials and incentivize collection and processing.

What’s Next?

While the upward trend in PET thermoform recycling is encouraging, there is still a considerable gap between current practices and the potential for full-scale integration into the circular economy. More collaboration across the value chain—from producers and retailers to recyclers and policymakers—is essential. Consumer education also plays a vital role in increasing participation rates and minimizing contamination.

As extended producer responsibility (EPR) programs gain traction, they may help fund improvements in infrastructure and public outreach. Building trust and transparency around recycling practices can further boost participation and ensure that the materials collected are of sufficient quality to be reused effectively.

The bottom line is clear: the U.S. is not yet collecting enough PET post-consumer recycled content to meet growing demand. PET thermoforms represent a largely untapped resource that could help fill this gap. Continued innovation, infrastructure investment, and consumer engagement will be key to unlocking their full potential.

With the groundwork laid and momentum building, the future of PET thermoform recycling looks more promising than ever—but realizing that future will require a collective, sustained effort across the entire recycling ecosystem.

Maryland and Washington recently became the sixth and seventh states to approve extended producer responsibility (EPR) bills for packaging. One in five Americans now lives in states with EPR laws. Meanwhile, in Oregon, the first reporting deadline for Producers has taken place, and the program is set to begin operations on July 1, 2025. Oregon’s program will be the first fully operational EPR system for packaging in the U.S.

Plastic Ingenuity earned a Silver Medal from EcoVadis, a global platform that provides sustainability ratings for businesses by assessing their environmental, social, and ethical performance across various industries. With this Silver Medal, Plastic Ingenuity has risen to the top 15% of companies assessed by EcoVadis.

Combined population of states with EPR packaging laws.

Recycling rate of packaging materials in seven worldwide jurisdictions with EPR studied by the Recycling Partnership.

Potential recapture of lost material economic value in EPR states.

Our team is recharging for the summer in anticipation of many exceptional events this fall:

- The PI team will attend PackExpo in Las Vegas, NV, from September 29th to October 1st. Stop by our booth in the lower South Hall 18062 to say hello.

- Zach Muscato will be speaking about “Seizing the Opportunity: How Packaging Convertors Drive Environmental Impact for Brand Owners” at the Sustainable Packaging Coalition’s Advance event in Boston, MA from September 29th to October 1st.

- Zach Muscato will be on a panel discussing sustainable design practices at AMI’s Sustainability in Design in Packaging Conference in Cleveland, OH on November 11th.