Understanding Packaging EPR: What Brands Need to Know Get up to speed…

Welcome back to PI Circular! In this edition, we will reflect on the progress made and challenges we encountered on our journey to a more circular economy for plastics in 2023.

1. EPR Proliferation

2023 will be remembered as the year Extended Producer Responsibility (EPR) legislation for packaging took shape in the U.S. Four states have passed EPR legislation to date: Maine, Oregon, California, and Colorado. The EPR plan in Colorado took a major step forward this year with the selection of Circular Action Alliance (CAA) as the producer responsibility organization (PRO). The PRO is led by major brands such as Coca-Cola, Keurig Dr Pepper, General Mills, and Unilever, to name a few.

California’s EPR legislation, SB54, is the most widely discussed EPR bill due to its aggressive targets for recycling and source reduction. The bill calls for effective recycling rates of 30% by 2028 and 65% by 2032 for all covered materials. Source reduction targets are set at 10% by 2027 and 25% by 2032. The bill also establishes a pollution mitigation fund requiring producers to raise $500,000,000 per year from 2027 – 2037. The impending legislation is sparking brands and producers to evaluate their packaging portfolio in advance of the bill’s implementation to determine potential risks and impacts.

2. Concerted Global Action

The United Nations Environment Programme (UNEP) continued to make progress toward an international legally binding treaty to address plastic pollution. UNEP hopes to complete the treaty by the end of 2024. Measures under evaluation for inclusion in the treaty include waste management infrastructure, widespread adoption of EPR programs, elimination of “problematic” materials, and controls on primary production. The treaty will continue to take shape in 2024 with the next milestone being the fourth Intergovernmental Negotiating Committee session (INC-4) in Canada at the end of April.

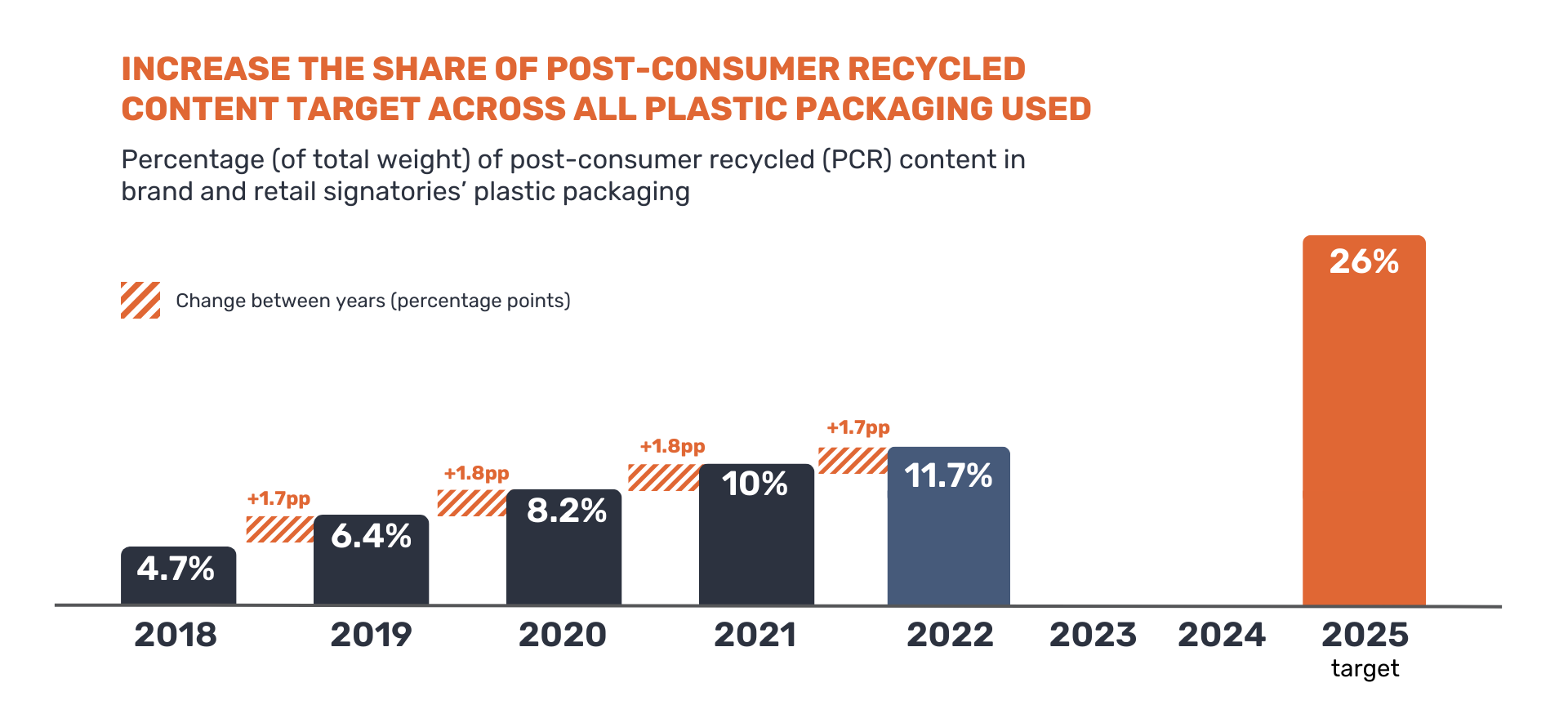

The need for concerted global action to advance circularity efforts was highlighted in the Ellen MacArthur Foundation’s five year progress report on The Global Commitment. The report acknowledges signatories will not meet their collective 2025 targets, although signatories made more progress than the industry as a whole. One bright spot is uptake of post-consumer recycled materials. For the fifth consecutive year, signatories increased their use of PCR content, from 10.0% in 2021 to 11.7% in 2022. This is now more than double the 4.7% starting point in 2018, with the top quartile nearly tripling their share of PCR over the past five years.

Source: Ellen MacArthur Foundation

3. Sluggish PCR Markets

2023 was a difficult year for many stakeholders operating in the recycling industry. Macroeconomic factors impacted the demand for recycled material in fiber applications. Fibers for applications like carpeting and textiles, are a significant end market for recycled materials. Demand in these end markets declined significantly due to destocking and recessionary pressures.

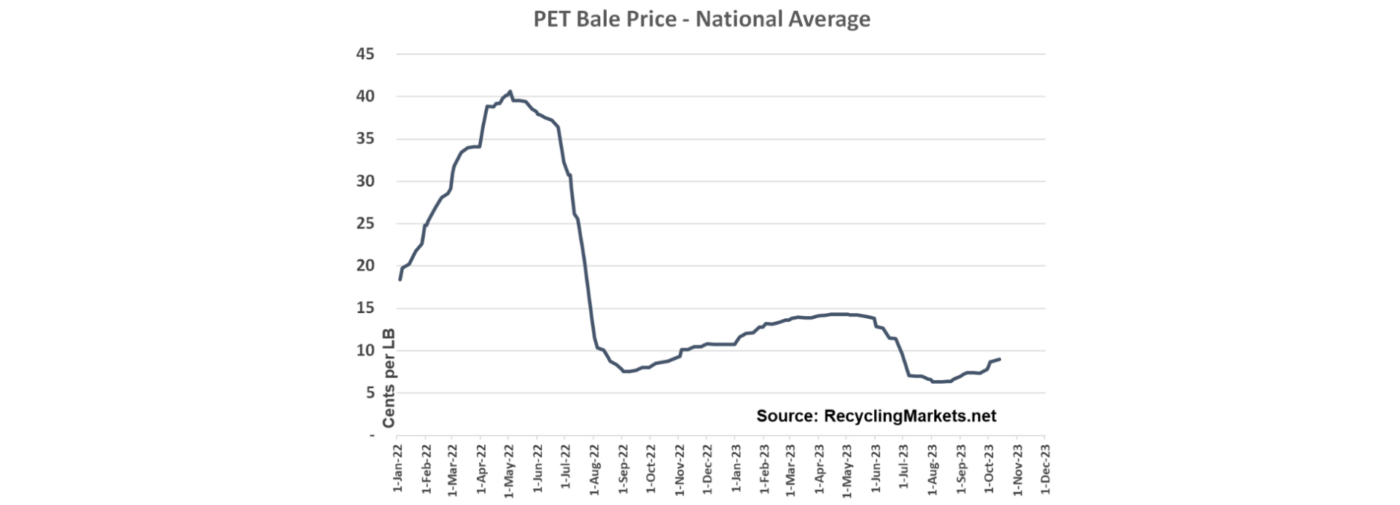

The impact of destocking and softening fiber demand on PET bale pricing is reflected in this chart from recyclingmarkets.net:

PET bale pricing peaked in the spring of 2022 above 40 cents per pound. Pricing bottomed in the fall of 2022 and remained depressed in 2023. This decline in pricing has placed economic burdens on MRFs selling PET bales at these depressed levels. Reclaimers were also under pressure, given the softening demand for recycled PET flake. This comes when many reclaimers are planning or implementing capacity expansions to meet anticipated long-term increases in demand. A rebound in recycled PET pricing is needed to support the capital necessary to fuel capacity expansion. Many market participants are calling for adopting long-term pricing agreements to reduce volatility and provide stability to the market.

4. Advanced Recycling Makes Strides

Several advanced recyclers made progress toward mass commercialization of their technologies. Advanced recycling involves the breakdown of plastic waste into its basic building blocks, which can be used to create virgin-quality plastics. PureCycle completed their first mass production facility to recycle polypropylene items via their purification process, although the company declared force majeure in September after a power failure. Their first commercial shipment was produced in November.

Eastman made strides on their first commercial depolymerization facility in Kingsport, TN. The operation is expected to be operational by the end of 2023. The company will use a methanolysis process to break down polyesters into their monomer building blocks. The building blocks will be reassembled to make virgin quality polymers for a variety of end markets.

5. Decarbonizing Supply Chains

78% of people believe that climate change is occurring and is primarily caused by humans. People surveyed also believe companies bear the most responsibility for change, even higher than the actions of governments and individuals. In this context, corporations are making public pledges on climate action.

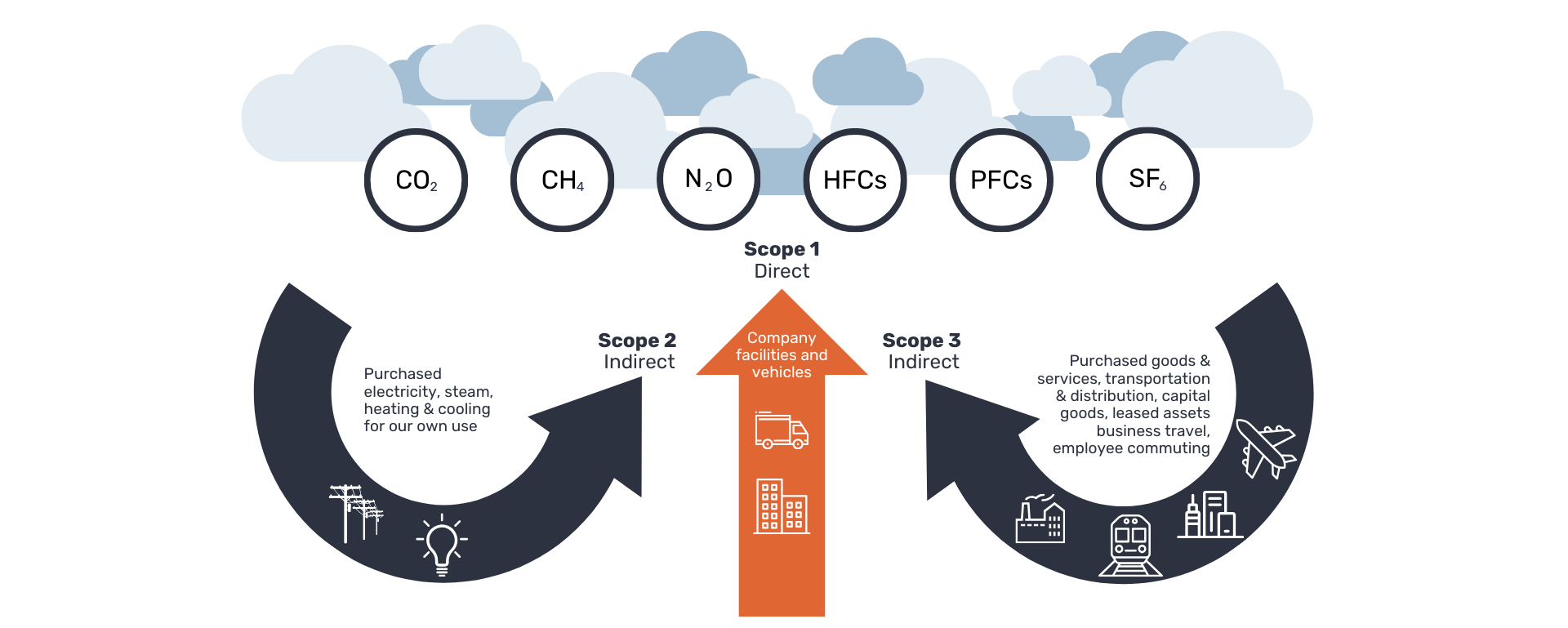

The Science Based Target initiative (SBTi) is an influential NGO helping to drive climate action. SBTi helps organizations in the private sector set science-based emission reduction targets. The science-based targets are intended to align with the goals of the Paris Agreement to limit global warming to below 1.5 degrees Celsius above pre-industrial levels. SBTi provides organizations with the framework to assess Scope 1, 2, and 3 emissions and guidance to set ambitious reduction targets.

Source: Edison Energy

Packaging is considered a purchased good and is therefore classified as a Scope 3 emission for brands and OEMs. Scope 3 emissions are expected to come into more focus as these organizations make progress on their Scope 1 & 2 emissions and transition resources to reducing Scope 3 impacts. The primary method stakeholders are leveraging to reduce Scope 3 emissions from plastic packaging is incorporating recycled materials since using recycled materials significantly reduces the embodied carbon of a product.