Understanding Packaging EPR: What Brands Need to Know Get up to speed…

Welcome back to PI Circular! In this edition, we will examine the Post-Consumer Recycled (PCR) material market for rigid packaging, such as thermoforms.

What is Happening with PCR?

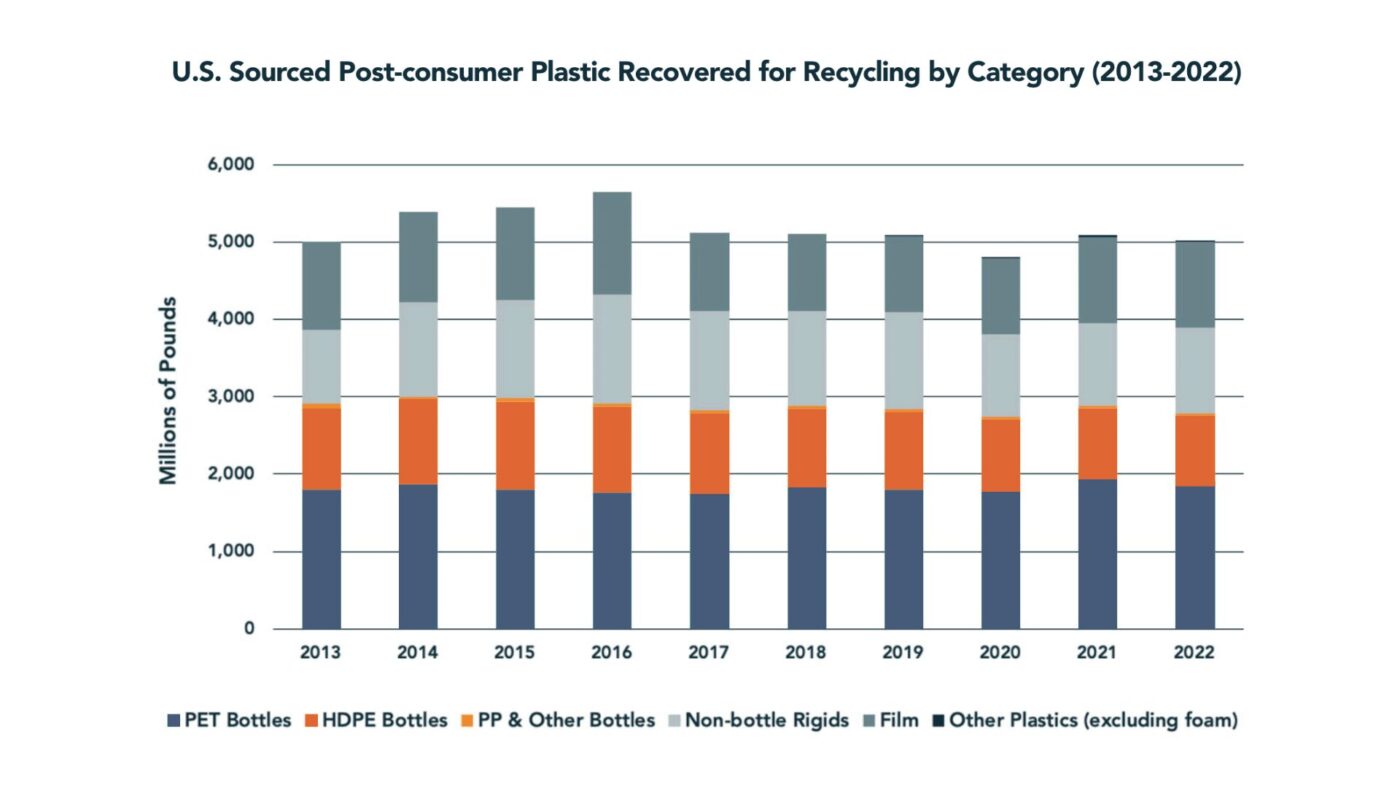

Let’s unpack this question by examining the PCR supply and demand factors. The amount of plastic material waste collected in the U.S. from consumers has been static over the past decade, hovering around 5 billion lbs per year. The stagnation in collection is evident in this chart from Stina, showing the recovery rate for recycling by category from 2013 – 2022:

Source: 2022 Plastic Recycling Data

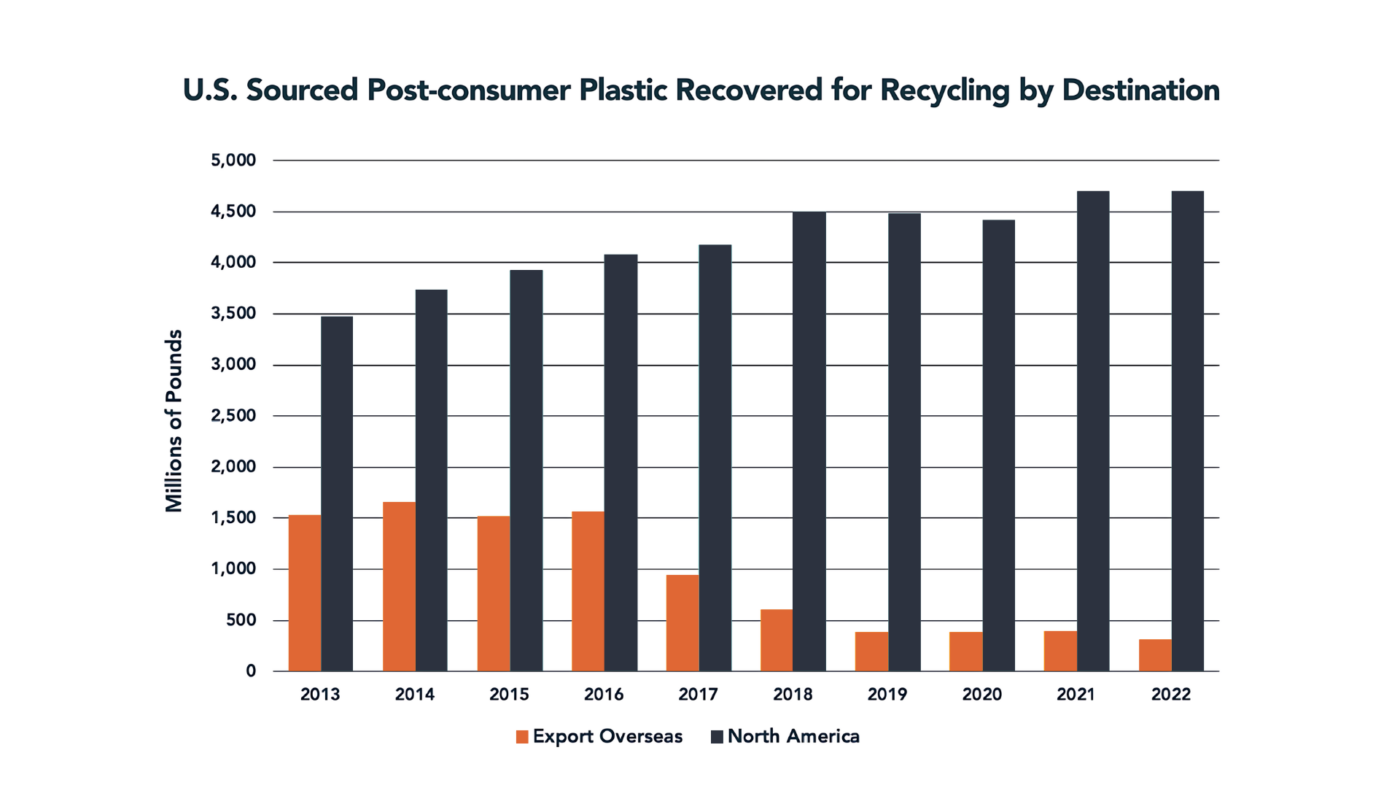

Although post-consumer waste collection has stagnated, domestic reclamation of the material collected for recycling has increased significantly. The U.S. exported 30.6% of post-consumer plastic materials overseas in 2013. That number is down to 6.3% as of 2022. The increase in domestic reclamation (blue bars) and decrease in exports (orange bars) is highlighted in this chart from Stina:

Source: 2022 Plastic Recycling Data

North American reclamation of post-consumer plastic material collected in the U.S. has increased by about 1.2 billion lbs, or 35%, since 2013. Domestic plastic reclaimers import additional waste, especially PET, to service the rising domestic demand for PCR. NAPCOR estimates imports for recycled PET in 2023 at 230 million lbs.

In short, the U.S. is collecting roughly the same amount of post-consumer plastic material as we did ten years ago, but we are using a much higher share domestically due to increasing domestic demand and waste export restrictions.

What is Driving Demand for PCR?

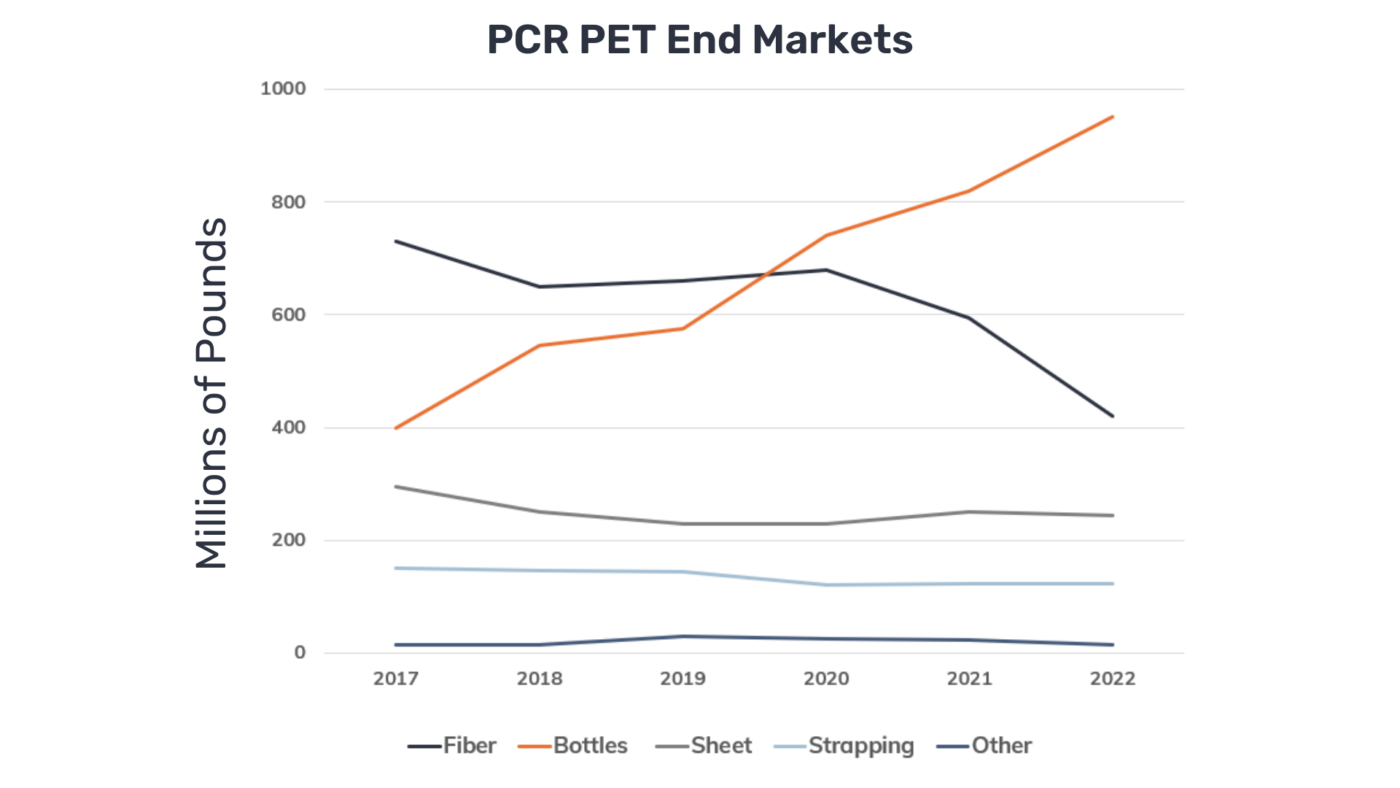

Voluntary brand commitments to increase the PCR content in packaging is a significant factor in rising domestic PCR demand. For one point of reference, the amount of PET PCR used in beverage bottles has more than doubled since 2017. As demand for PCR in packaging increases, impacts on the fiber market due to broader economic conditions have caused a significant decrease in demand for PCR PET used in fiber applications. The following chart from NAPCOR highlights these trends:

Source: NAPCOR 2022 Recycling Report ($)

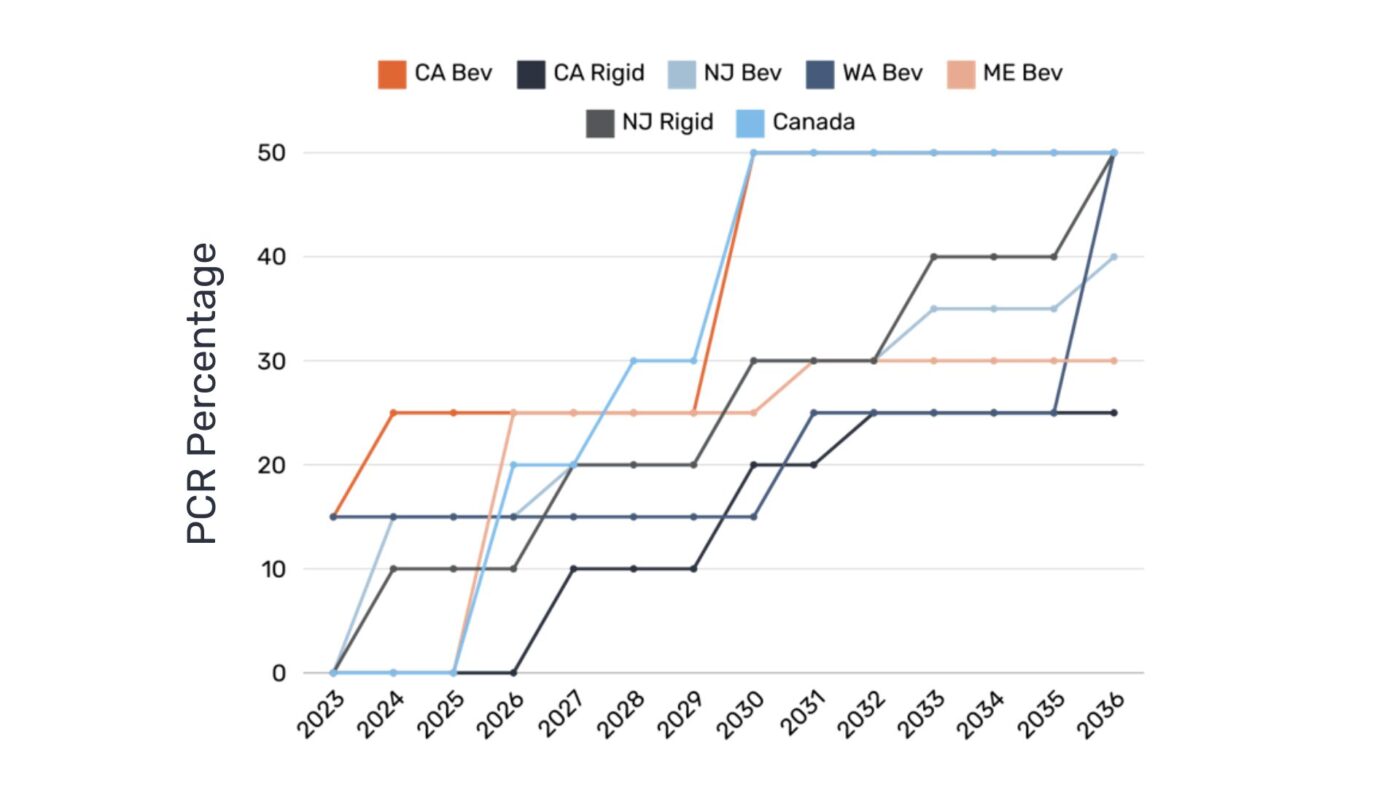

PCR content legislation is expected to drive additional PCR demand. Five states and Canada have enacted legislation mandating PCR content in beverage containers and rigid packaging. Canada is mandating 50% recycled content by 2030 in rigid packaging. This chart, courtesy of NAPCOR, highlights the potential impact of these mandates over the next decade:

Source: NAPCOR 2022 Recycling Report ($)

What Does this Mean for the PCR Market?

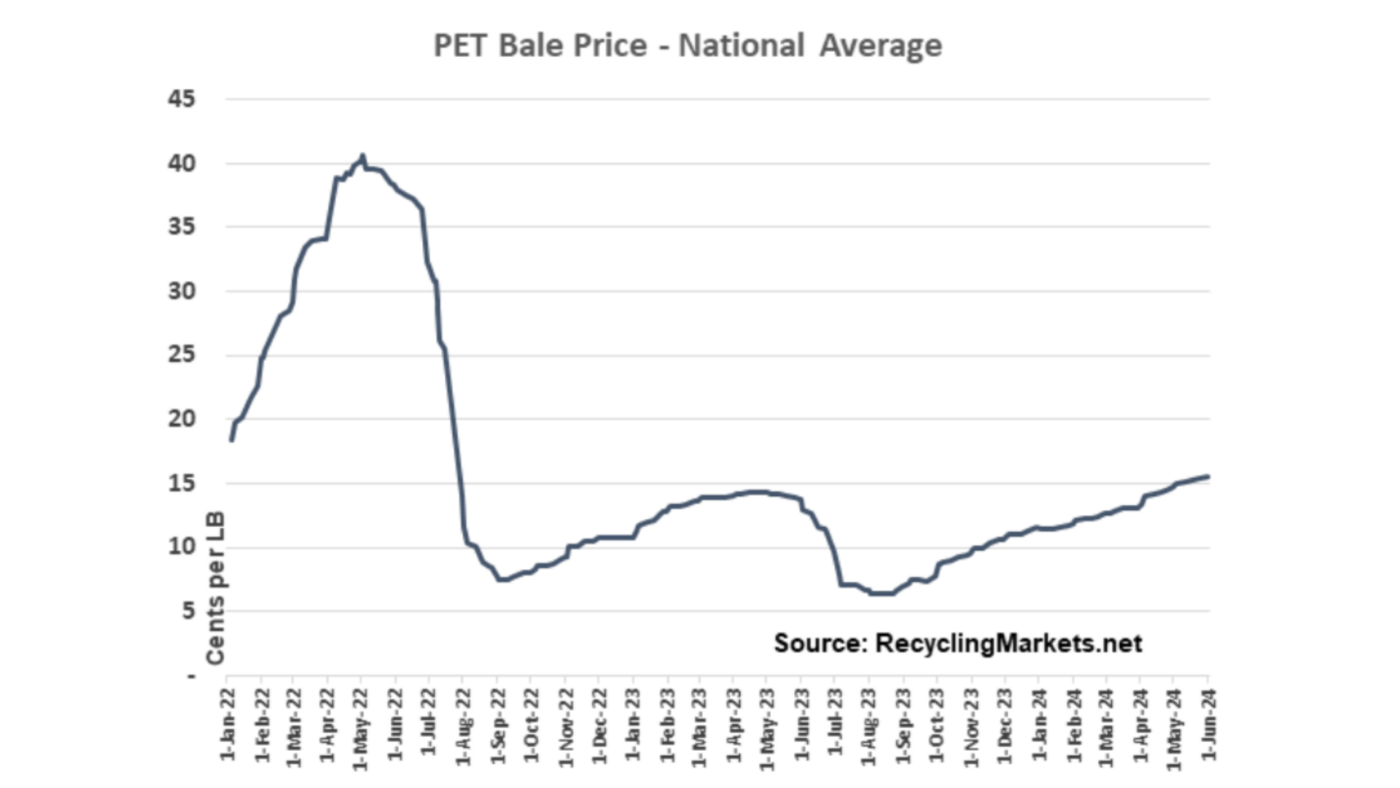

To help understand the complexities of the PCR market, let’s examine the recent developments in the PET PCR market. Although demand for PCR in packaging is significantly increasing, the decrease in demand from fiber markets has a meaningful impact on the market. Additionally, end markets that can flex between virgin and PCR sources can negatively impact PCR demand when virgin pricing is relatively low. The net effect of these market dynamics is a decrease in PET bale pricing from 2022 highs, as evident by this chart:

Bale pricing is an indicator of the recycling market. PET bale pricing peaked in the spring of 2022 above 40 cents per pound. Pricing bottomed in the fall of 2022 and remained depressed. This decline in pricing has placed economic burdens on Material Recovery Facilities (MRFs) and reclaimers. This comes when many MRFs and reclaimers are planning or implementing capacity expansions to meet anticipated long-term increases in demand.

What’s the Bottom Line for CPGs?

CPGs can help bolster the PCR market by considering the following actions:

The PCR market is very complex. Although there are positive trends with domestic reclamation for packaging applications, we need to expand efforts to collect more material for domestic recycling.

Elevate your packaging knowledge with Good Information Courses from Plastic Ingenuity! Discover the ins and outs of thermoforming and its sustainability role with this free, in-depth online course. From polymers to recycling techniques, it’s everything a packaging professional needs for a deeper understanding of thermoformed packaging. Claim your Thermoforming Circularity Certificate upon completion! Begin online today: Thermoform Circularity | Plastic Ingenuity

Minnesota became the fifth state to sign EPR legislation into law. The bill requires producers to choose a Producer Responsibility Organization (PRO) by January 1st, 2025. The PRO will be required to submit their stewardship plan by October 2028. Producers must fund 50% of the annual net cost of recycling programs in 2029. The reimbursement rate increases to 90% by 2031. Statewide recycling targets and PCR content requirements will be determined by a needs assessment. Minnesota becomes 5th US state with packaging EPR law | Packaging Dive

Our corporate sustainability manager, Zach Muscato, appeared in Packaging Technology Today to discuss the switch from OPS to PET for snack trays. Read the full article here: Transitioning OPS to PET – Packaging Technology Today.

U.S. sourced post-consumer plastic pounds recovered for recycling in 2022

U.S. sourced post-consumer plastic percentage acquired by North American reclaimers in 2022

Increase in domestic reclamation of U.S. post-consumer plastic pounds in last ten years

Our team is recharging for the summer in anticipation of many exceptional events this fall: